Ultimate Guide to Trading With Exness

Trading with Exness is becoming increasingly popular among traders worldwide due to its user-friendly interface and competitive trading conditions. For those looking to embark on their trading journey or improve their existing strategies, Exness provides a platform that caters to both beginners and experienced traders. To start your journey today, visit Trading With Exness https://nextradeplus.com/en/exness-registration/. In this article, we delve into key aspects of trading with Exness, including account types, trading instruments, strategies, and risk management, to ensure that you are well-prepared to make informed trading decisions.

Understanding Exness: A Comprehensive Overview

Exness is a global brokerage firm founded in 2008, providing trading services on forex, cryptocurrencies, commodities, and other financial instruments. What sets Exness apart is its commitment to high transparency, swift execution, and reliability. The company’s operational licenses granted by respected financial authorities serve as a testament to its credibility in the trading community.

Account Types: Finding the Right Fit

Exness offers several types of trading accounts designed to suit the varied needs of its users. Here’s a brief overview:

- Cent Account: Ideal for beginners, this account allows you to trade with very low deposits and minimal risk.

- Mini Account: Designed for those who want to trade larger volumes while still minimizing risk.

- Standard Account: This account type is suited for more experienced traders looking for greater leverage and larger lot sizes.

- ECN Account: For professional traders, the ECN account offers direct market access and competitive spreads.

Choosing the right account type is the first step towards successful trading. Each account has its unique advantages, and traders should consider their risk tolerance, trading strategies, and objectives when making a decision.

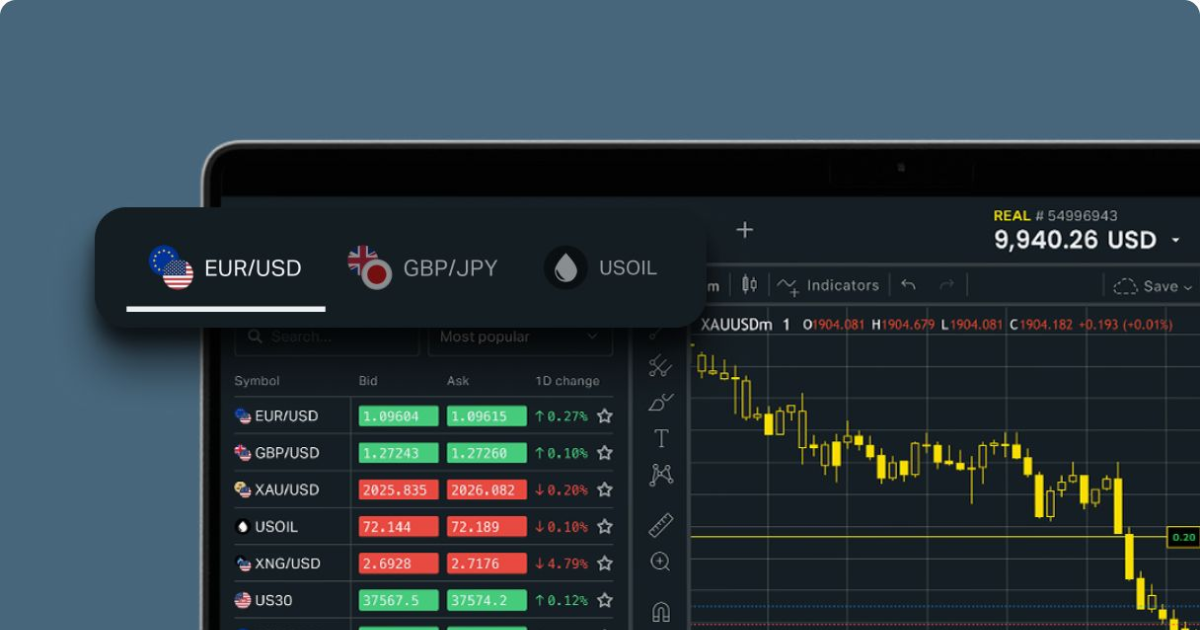

Trading Instruments: Diversity at Your Fingertips

One of the prominent features of Exness is its extensive range of trading instruments. Traders can choose from over 200 financial instruments, including:

- Forex Pairs: Major, minor, and exotic currency pairs are available for trading.

- Cryptocurrencies: Trade popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

- Commodities: Includes gold, silver, oil, and more.

- Indices: Global stock indices provide traders with an opportunity to invest in major economies.

This variety enables traders to diversify their portfolios and capitalize on different market conditions.

Developing a Trading Strategy

Having a well-defined trading strategy is crucial for success in the financial markets. When trading with Exness, consider the following approaches:

1. Technical Analysis

Technical analysis involves studying historical price movements and using various indicators to predict future price actions. Traders often use tools like moving averages, MACD, and RSI to make informed decisions.

2. Fundamental Analysis

This approach involves analyzing economic indicators, news releases, and other fundamental factors that can influence market movements. Understanding how global events affect currencies can provide traders with valuable insights.

3. Price Action Trading

Price action trading focuses on historical price movements, ignoring technical indicators. Traders rely on candlestick patterns and market structures to make decisions.

Regardless of the strategy you choose, it’s essential to test it on a demo account first to refine your skills and build confidence.

Risk Management: Protecting Your Capital

Effective risk management is vital for long-term trading success. Here are key strategies to protect your capital:

- Use Stop Loss and Take Profit Orders: Setting these orders can help you manage your trades effectively and minimize losses.

- Risk-to-Reward Ratio: Aim for a risk-to-reward ratio of at least 1:2, meaning you should aim to make at least twice the amount you are risking.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade. Diversification can help mitigate risks.

By implementing strong risk management techniques, you can safeguard your investments and increase the likelihood of long-term success.

Advanced Trading Features Offered by Exness

As you become more familiar with trading, consider leveraging some of the advanced features offered by Exness:

1. Copy Trading

If you lack the time or expertise to trade actively, Exness allows you to copy successful traders automatically. This feature can be an excellent way for beginners to benefit from the knowledge of more experienced traders.

2. Forex Signals

Access to forex signals can help traders make informed decisions. Exness provides access to trading signals offered by experienced analysts to aid your strategy.

3. APIs for Algorithmic Trading

For tech-savvy traders, Exness offers the option to use APIs for algorithmic trading, allowing them to create automated trading systems that execute based on predefined criteria.

Conclusion: Start Trading With Confidence

Trading with Exness can be a rewarding experience if approached with the right knowledge and strategies. From understanding the varied account types and instruments to developing well-defined trading approaches and risk management techniques, you can effectively navigate the forex market. Always remember to stay informed and continuously improve your skills. With dedication, you can thrive in your trading journey and achieve your financial goals.

Explore the opportunities awaiting you at Exness, and start your trading journey today!